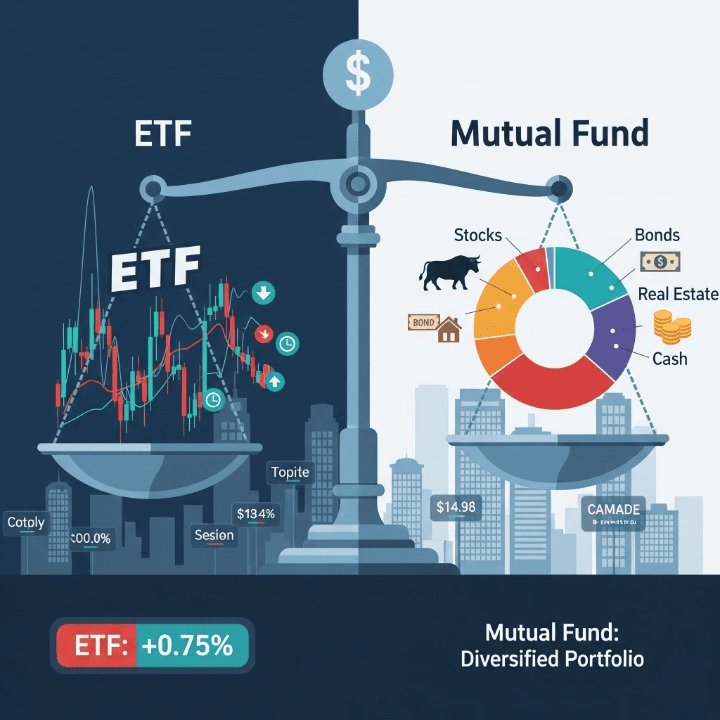

Choosing the right investment vehicle is a pivotal step for any investor, whether you’re just starting out or have years of experience. Among the countless options, Exchange-Traded Funds (ETFs) and mutual funds stand out as two of the most popular and effective choices. Both offer distinct pathways to build a diversified portfolio and participate in market growth. However, their structural differences, operational mechanics, and cost implications can significantly impact your long-term returns. Understanding these fundamental divergences is essential for making informed decisions that align with your personal financial goals and risk tolerance. This comprehensive guide will explore each option in detail, empowering you to navigate the complexities of long-term investing with greater clarity and confidence.

Understanding Exchange-Traded Funds (ETFs)

Exchange-Traded Funds, or ETFs, are investment funds that hold a basket of assets such as stocks, bonds, or commodities. A defining characteristic of an ETF is its trading mechanism: it is bought and sold on a stock exchange throughout the day, just like an individual stock. This allows for real-time pricing and provides investors with exceptional trading flexibility.

Most ETFs are designed to track a specific market index, like the S&P 500, a particular industry sector, or even a global bond market. This passive management approach typically results in lower expense ratios compared to many actively managed funds. Investors often choose ETFs for their instant diversification benefits, cost-efficiency, and the ability to execute trades with precision, adapting quickly to market changes. They are a highly regarded tool for strategic portfolio management due to their versatility and transparency.

ETFs provide a simple way to gain exposure to a broad market or a specific sector without having to research and buy individual securities. For example, by purchasing a single ETF that tracks the Nasdaq 100, you can instantly own a small stake in the 100 largest non-financial companies listed on the Nasdaq exchange. This makes them a powerful tool for building a well-rounded and diversified investment portfolio with relative ease.

Deciphering Mutual Funds

Mutual funds are another widely used investment vehicle where money from multiple investors is pooled together. This collective capital is then professionally managed by a fund manager who invests it across a diversified portfolio of stocks, bonds, or other assets, adhering to the fund’s stated investment objectives.

Unlike ETFs, mutual funds are typically priced only once daily, specifically after the market closes. All purchases and sales of mutual fund shares are executed at this end-of-day Net Asset Value (NAV). Mutual funds can be either actively managed, where managers seek to outperform a specific benchmark, or passively managed, tracking an index similar to many ETFs.

A significant advantage of mutual funds is the benefit of professional management. The fund manager handles all aspects of asset selection and allocation, simplifying portfolio management for those who prefer a more hands-off approach. This can be especially appealing to investors who lack the time, expertise, or desire to actively manage their own investments. Mutual funds also provide extensive diversification across various investment objectives, from aggressive growth to conservative income, offering a straightforward path for long-term investing.

Key Differences: Trading and Liquidity

One of the most significant distinctions between these two investment vehicles lies in their trading mechanism and liquidity. ETFs offer unparalleled trading flexibility. They can be bought and sold at current market prices throughout the entire trading day, similar to individual stocks. This feature provides investors with the ability to react instantly to market movements or implement precise trading strategies, such as setting stop-loss orders. This real-time liquidity is a major draw for those who prefer active portfolio management and want to capitalize on intraday price fluctuations.

In stark contrast, mutual funds operate on an end-of-day pricing model. All transactions, whether buying or selling shares, are executed at the fund’s Net Asset Value (NAV) calculated after the market closes. This means you cannot trade mutual funds during market hours, limiting your ability to react to sudden news or market shifts in real time. For most long-term investors, this is not a major issue, but for those who value precise timing and control, the difference is critical. The choice often hinges on an investor’s desired level of control and responsiveness to market dynamics.

Cost Structures and Expense Ratios

Understanding the cost implications of your investment vehicles is paramount, as fees can significantly erode long-term returns. ETFs generally boast lower expense ratios. These ratios represent the annual fees charged as a percentage of assets under management. The lower costs in ETFs are often attributed to their typically passive management style, which involves less active trading and research. However, investors purchasing ETFs also incur standard brokerage commissions each time they buy or sell shares, similar to trading stocks. While many brokerages now offer commission-free ETF trading, this is not always the case.

Conversely, mutual funds can often carry higher expense ratios, particularly those that are actively managed. These higher costs are due to the professional expertise, research, and active trading decisions involved. Furthermore, some mutual funds may impose sales loads, which are either upfront fees (front-end loads) or deferred fees upon sale (back-end loads). These costs directly impact your net returns. A careful evaluation of all associated fees is a critical component of sound financial planning. The total cost of owning an investment is a key factor that can make or break your ability to achieve your long-term financial goals.

Diversification and Portfolio Management

Both ETFs and mutual funds are excellent tools for achieving portfolio diversification, a fundamental principle of sound long-term investing. By investing in a single ETF or mutual fund, you gain exposure to a broad range of underlying assets, which helps mitigate risk compared to holding individual stocks.

ETFs offer incredible versatility in how you can diversify. They can track broad market indices, specific industry sectors, geographic regions, or various asset classes like commodities or real estate. This allows investors to construct highly customized portfolios, targeting specific investment themes or exposures. This ability to mix and match different ETFs makes them a powerful tool for sophisticated portfolio construction.

Mutual funds also provide extensive diversification across various investment objectives. The professional managers of mutual funds handle all aspects of asset selection and allocation, simplifying portfolio management for those who prefer a more hands-off approach. This is an attractive feature for investors who want to delegate the complex decisions of where and when to invest to a professional. The choice often depends on an investor’s comfort level with active involvement in their portfolio’s composition.

Tax Implications

Considering the tax implications of your investment vehicles is crucial, especially when investing in taxable accounts. ETFs are generally considered more tax-efficient than mutual funds. This is primarily due to their unique redemption mechanism. When large institutional investors redeem ETF shares, they often receive a basket of underlying securities rather than cash (an “in-kind” redemption). This process helps the ETF manager avoid selling securities and realizing taxable capital gains that would otherwise be distributed to shareholders. This unique structure allows ETFs to minimize capital gains distributions, which can be a significant advantage for long-term, buy-and-hold investors.

Mutual funds, particularly actively managed ones, frequently buy and sell securities within their portfolio. If these sales result in net capital gains, the fund must distribute these gains to its shareholders, often annually. These capital gains distributions are taxable events for investors, even if they haven’t sold any of their fund shares. This can lead to unexpected tax liabilities. Understanding these differences can significantly impact your after-tax returns and overall financial planning strategy. While tax efficiency is an important consideration, it should not be the sole determinant of your investment choices.

Which Investment Vehicle is Right for You?

Deciding between ETFs and mutual funds ultimately comes down to your individual financial situation and investment preferences. There is no universally “better” option; the ideal choice depends on several factors, including your specific investment goals, your personal risk tolerance, and your time horizon.

ETFs might be more appealing to investors who prioritize trading flexibility, cost-efficiency, and the ability to implement precise, real-time portfolio adjustments. They are often favored by those with a more hands-on approach to their investments, or those who want to build a highly customized portfolio with a wide range of options.

Conversely, mutual funds can be an excellent fit for investors seeking professional management, simplicity, and a more passive, long-term approach to their investment decisions. They are well-suited for individuals who prefer to delegate the investment process to a professional manager and focus on other aspects of their financial lives. Regardless of your choice, a well-diversified portfolio is key to long-term success.

Conclusion

The head-to-head comparison of ETFs vs. Mutual Funds reveals that both are powerful investment vehicles, yet they serve different investor needs and preferences. ETFs offer attractive features such as intraday trading capabilities, generally lower expense ratios, and enhanced tax efficiency, making them a flexible tool for various portfolio management strategies. Mutual funds, on the other hand, provide the benefit of professional management, convenience, and a straightforward approach to long-term investing, particularly for those who prefer a less hands-on role.

Your personal financial journey is unique. Therefore, the most effective choice will always be one that perfectly aligns with your specific investment goals, comfort with market volatility, and desired level of involvement. We strongly encourage you to thoroughly understand the nuances of each option, conduct further research, and consider seeking personalized advice from a qualified financial professional. Empowering yourself with knowledge is the first crucial step toward achieving lasting financial success and robust financial planning.