Introduction

Many car owners often feel overwhelmed by the complexities of their auto insurance. They sign on the dotted line without fully grasping what their policy truly covers. This lack of understanding can lead to significant financial surprises. It might also cause unexpected stress during an accident or claim. Understanding your car insurance policy is not just a recommendation. It is an essential step towards responsible vehicle ownership. This article will demystify the various components of car insurance. We will break down key terms and coverages. Our goal is to empower you with the knowledge needed for informed decisions. You will gain a clear picture of your protection. This guide will help you navigate the world of auto insurance with confidence. It will ensure you are well-prepared for the road ahead.

Key Components of Your Car Insurance Policy

Every car insurance policy has fundamental elements. These components define your coverage and responsibilities. The “declarations page” is your policy’s summary. It lists your name, vehicle information, and coverage types. It also shows your limits, deductibles, and premium. The “policy period” specifies when your coverage is active. It is typically six months or one year. Understanding these basics is the first step. It helps in truly understanding your car insurance policy. Reviewing this page ensures accuracy. Always check for correct vehicle and driver details. Mistakes here can impact your coverage validity. Keep your declarations page accessible for reference. This will save time and confusion later.

Another crucial part is the “policy booklet” or “conditions.” This document details the terms of your agreement. It outlines what is covered and what is excluded. It also explains your obligations as a policyholder. Familiarize yourself with these conditions. They govern how claims are processed. Knowing them helps you understand your rights. It also clarifies your duties after an incident. This comprehensive understanding ensures no surprises. It is key to leveraging your auto insurance benefits fully.

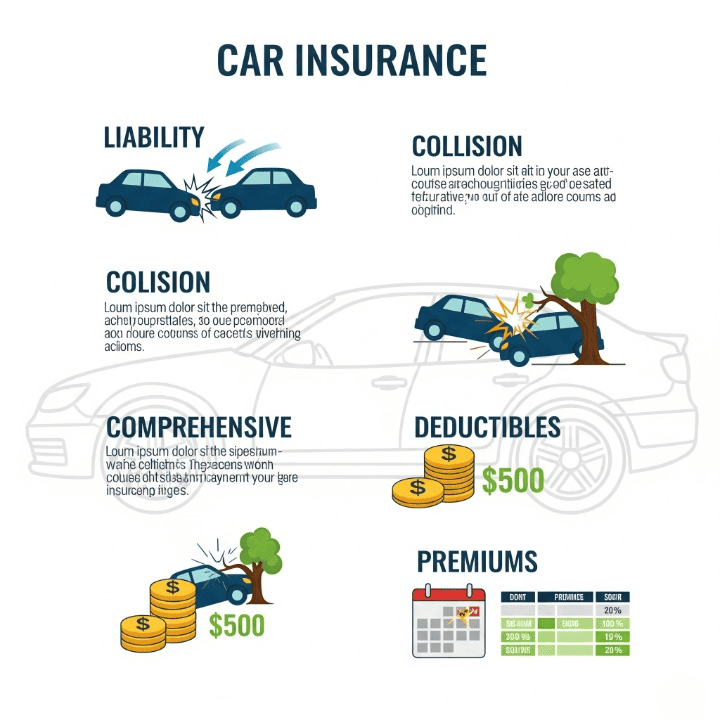

Essential Types of Car Insurance Coverage Explained

Car insurance offers several types of coverage. Each type serves a specific purpose. Understanding these coverages is vital. It ensures you have adequate protection. The primary types include:

- Liability Coverage: This is mandatory in most states. It covers damages you cause to others. This includes bodily injury and property damage. Bodily injury covers medical expenses and lost wages. Property damage pays for repairs to other vehicles or property.

- Collision Coverage: This pays for damages to your own car. It applies if you hit another vehicle or object. This coverage is usually optional. Lenders often require it if you have a car loan.

- Comprehensive Coverage: This protects your car from non-collision incidents. Examples include theft, vandalism, fire, and natural disasters. It also covers damage from hitting an animal.

- Personal Injury Protection (PIP) / Medical Payments (MedPay): PIP covers medical expenses. It also covers lost wages for you and your passengers. This applies regardless of who is at fault. MedPay offers similar medical benefits.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This protects you. It applies if an at-fault driver has no insurance. It also applies if they have insufficient coverage. This can cover medical bills and car repairs.

Each coverage type adds a layer of protection. Combining them offers robust security. It is important to assess your needs carefully. This helps you select the right mix of coverages. This detailed breakdown enhances understanding your car insurance policy.

Deciphering Deductibles, Premiums, and Limits

When you are understanding your car insurance policy, three terms stand out: deductibles, premiums, and limits. Your “premium” is the amount you pay for coverage. It can be paid monthly, quarterly, or annually. Many factors influence your premium. These include your driving record and vehicle type. The coverage amounts you choose also play a role. A higher premium usually means more comprehensive protection.

A “deductible” is the amount you pay out-of-pocket. This payment is made before your insurance company pays for a claim. Deductibles typically apply to collision and comprehensive coverages. Choosing a higher deductible often lowers your premium. Conversely, a lower deductible means higher premiums. It is a balancing act between upfront costs and potential claim expenses. Consider your financial situation when selecting a deductible. Ensure it is an amount you can comfortably afford.

“Limits” refer to the maximum amount your insurer will pay. This applies for a covered loss. Liability limits are usually shown as three numbers. For example, 100/300/50. This means $100,000 per person for bodily injury. It is $300,000 total per accident for bodily injury. It also means $50,000 for property damage. Understanding these limits is crucial. It helps prevent out-of-pocket expenses beyond your deductible. Ensure your limits adequately protect your assets. This is another key aspect of understanding your car insurance policy.

The Claims Process: What to Expect

Navigating the claims process can seem daunting. However, understanding the steps makes it easier. After an accident, ensure everyone’s safety first. Contact the police if necessary. Then, exchange information with other involved parties. This includes names, contact details, and insurance info. Document the scene with photos. Gather statements from witnesses if possible. These steps are crucial for a smooth claim.

Next, report the incident to your insurance company promptly. Many insurers offer mobile apps for quick reporting. Provide all collected information accurately. Your insurer will assign a claims adjuster. The adjuster will investigate the accident. They will assess damages and determine fault. Cooperate fully with your adjuster. Provide any requested documents or details. This helps speed up the investigation. The goal is to reach a fair settlement based on your policy terms. Understanding your car insurance policy includes knowing this process. It prepares you for real-world scenarios.

Once the investigation concludes, you will receive a settlement offer. Review this offer carefully. Ensure it covers your damages and losses. If you have collision or comprehensive coverage, repairs will be arranged. Your deductible will apply here. If another party is at fault, their insurance might cover your damages. The claims process can take time. Patience and thorough documentation are key. Knowing what to expect reduces stress. It helps you advocate for your rightful coverage. This comprehensive guide helps in understanding your car insurance policy deeply.

Factors Affecting Your Car Insurance Costs

Many elements contribute to the cost of your car insurance. Your “driving record” is a primary factor. A history of accidents or traffic violations leads to higher premiums. Insurers view these as increased risk. Your “age and experience” also play a role. Younger, less experienced drivers typically pay more. This is due to their higher statistical risk.

The “type of vehicle” you drive impacts costs. Sports cars or luxury vehicles are more expensive to insure. They have higher repair costs and theft rates. Safety features can sometimes lower your premium. Where you “live” also matters. Urban areas with higher traffic or theft rates often mean higher premiums. This is compared to rural areas. Your “credit history” can also influence rates in some states. Insurers use it as a predictor of responsibility.

Finally, the “coverage amounts and deductibles” you choose directly affect costs. Higher coverage limits and lower deductibles increase premiums. Conversely, lower limits and higher deductibles reduce them. Exploring available “discounts” is also smart. Many insurers offer discounts for good students, multi-policy holders, or safe driving habits. Understanding these factors empowers you. It allows you to make choices that manage your premiums. This comprehensive knowledge is vital for understanding your car insurance policy effectively.

Conclusion

Understanding your car insurance policy is more than just a task. It is a fundamental aspect of financial literacy and personal protection. We have explored the critical components of a policy. We also delved into various coverage types. Furthermore, we deciphered deductibles, premiums, and limits. We have also illuminated the claims process. Finally, we examined the numerous factors influencing your insurance costs. This knowledge empowers you to make informed decisions. It helps you choose the right coverage for your unique needs.

An informed policyholder is a prepared policyholder. Regularly review your policy details. Ensure they align with your current circumstances and vehicle. Life changes, like buying a new car or moving, require policy adjustments. Do not hesitate to ask your insurance provider questions. Seek clarity on any terms you find confusing. Being proactive ensures you maximize your auto insurance benefits. It also prevents unwelcome surprises during a claim. Take the time to master this essential area. It will provide peace of mind on every journey.