Introduction

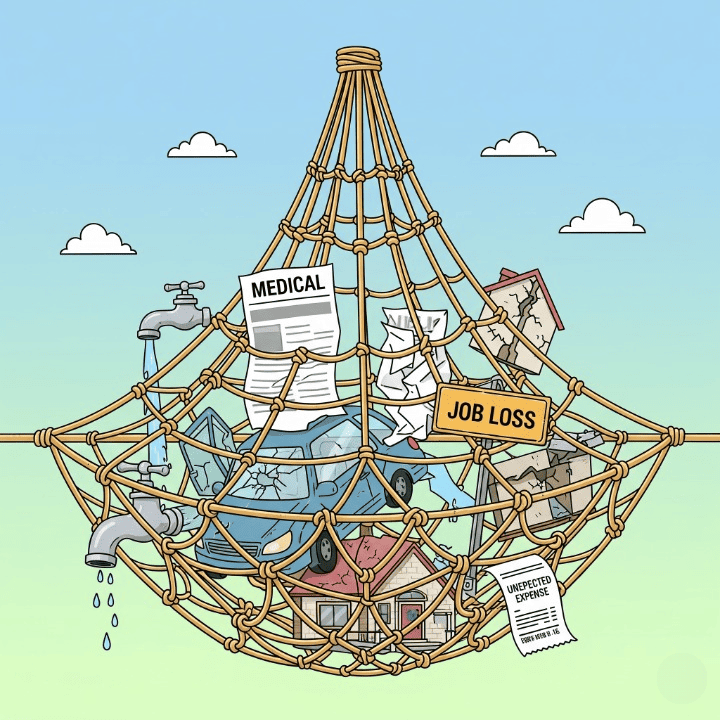

Life is full of surprises. Some are pleasant, others less so. Financial stability often feels like a distant dream. Many people struggle with unexpected expenses. Sudden car repairs can cause stress. Medical emergencies also arise. An unexpected job loss adds to this burden. This is where an emergency fund becomes essential. It acts as a financial safety net. Understanding its importance is crucial. Knowing how much to save provides peace of mind. This guide will explore the concept of emergency funds. We will discuss their role in personal finance. We will also help you determine the right amount for your specific situation. Preparing for the unforeseen is a cornerstone of sound financial planning. It protects your financial future and reduces anxiety.

What is an Emergency Fund?

An emergency fund is a stash of readily accessible cash. It is specifically set aside for unexpected financial crises. Think of it as your personal financial buffer. This fund should not be used for discretionary spending. It is distinct from other savings goals. These goals might include a down payment on a house. They could also involve saving for a vacation. An emergency fund provides a cushion. It helps you navigate life’s inevitable bumps. It prevents you from relying on high-interest credit cards. It also keeps you from taking out expensive loans. This fund is a fundamental part of financial security. It helps maintain your financial stability during tough times. It allows you to face challenges without derailing your long-term goals. Establishing this fund is a critical first step. It is key to building a resilient financial life.

Why is an Emergency Fund Crucial for Financial Security?

The importance of an emergency fund cannot be overstated. It offers significant peace of mind. Knowing you have a financial safety net reduces stress. It protects you from falling into debt. Unexpected events are a part of life. A medical emergency could arise without warning. Your car might break down unexpectedly. Home repairs can be costly and sudden. Job loss is another common reason for needing funds. These situations require immediate access to cash.

Without an emergency fund, these events can be devastating. You might accumulate high-interest debt. You could deplete your long-term investments. This fund acts as a shield. It safeguards your financial future. It ensures your stability during unforeseen circumstances. Building this fund is a proactive step. It demonstrates responsible financial planning.

- Protects against job loss: Provides income replacement.

- Covers medical emergencies: Handles unexpected health costs.

- Manages unforeseen repairs: Fixes car or home issues.

- Avoids high-interest debt: Prevents credit card reliance.

- Safeguards investments: Keeps long-term assets untouched.

How Much to Save: The 3-6 Month Rule

A common guideline suggests saving three to six months’ worth of living expenses. This benchmark is widely accepted by financial experts. To determine this amount, calculate your essential monthly outgoings. Include rent or mortgage payments, utilities, food, and transportation. Exclude discretionary spending like entertainment or dining out. For example, if your essential expenses are $2,500 per month. A three-month fund would be $7,500. A six-month fund would be $15,000. This range provides a solid starting point. It offers a balance between preparedness and practicality. Your specific circumstances will influence the ideal amount. It is a crucial step in building a robust financial foundation. It helps ensure you have adequate coverage. It prepares you for various unexpected life events. This widely used metric provides a clear savings target.

Beyond the Basics: Factors Influencing Your Emergency Fund Size

While the 3-6 month rule is a good start, several factors influence your ideal fund size. Job security plays a significant role. If you work in a volatile industry, consider saving more. Those with stable government jobs might need less. Family size is another critical aspect. A single individual often needs less than a family with dependents. Health conditions also matter. If you or a family member have chronic health issues, a larger fund is wise.

The stability of your income can affect this decision. Freelancers or those with commission-based pay might need more. Homeownership brings additional responsibilities. Property owners often face unexpected repair costs. Renters might have fewer housing-related emergencies.

Personal risk tolerance also influences your comfort level. Assess these factors honestly to tailor your savings goal. A personalized approach ensures optimal financial security. This thorough evaluation helps refine your emergency savings target. It moves beyond generic advice to meet your unique needs. Understanding these nuances is key to effective financial planning.

- Job Security: High job stability may allow for a smaller fund.

- Industry Volatility: Work in an unstable sector? Save more.

- Family Size: More dependents often require a larger safety net.

- Health Status: Chronic conditions might necessitate greater reserves.

- Income Stability: Variable income suggests a larger emergency fund.

- Homeownership vs. Renting: Homeowners face more potential repair costs.

- Access to Credit: Good credit can provide a temporary bridge, but should not replace savings.

- Insurance Coverage: Robust insurance might reduce fund requirements.

Where to Keep Your Emergency Funds

The location of your emergency funds is crucial. It must be liquid, safe, and easily accessible. High-yield savings accounts are often the best choice. These accounts offer better interest rates than traditional savings accounts. They ensure your money grows, even slightly, over time. Certificates of Deposit (CDs) can also be used. However, they typically have withdrawal penalties. This makes them less ideal for immediate emergencies. Money market accounts are another viable option. They offer slightly higher rates and check-writing privileges.

Avoid investing your emergency fund in the stock market. While stocks offer potential for high returns, they also carry significant risk. The value can fluctuate dramatically. You might need your funds when the market is down. This would force you to sell at a loss. The primary goal is preservation of capital. Safety and accessibility always outweigh potential growth.

Your emergency fund should be segregated. Keep it separate from your regular checking account. This separation helps prevent accidental spending. It reinforces its dedicated purpose. Choose an institution that is FDIC insured. This protects your deposits up to $250,000. It offers an essential layer of security. Select the option that balances safety and accessibility for your financial peace of mind.

Building and Maintaining Your Emergency Fund

Building an emergency fund takes discipline and consistency. Start by setting a realistic savings goal. Even small, regular contributions add up over time. Treat your emergency fund savings like a non-negotiable bill. Automate transfers from your checking to your savings account. This ensures you consistently contribute without thinking. Consider finding ways to cut unnecessary expenses. Reallocate those savings directly to your fund. A side hustle or extra income can accelerate the process. Every extra dollar saved brings you closer to your goal.

Once you reach your target amount, the work is not over. Maintain your emergency fund diligently. Replenish it whenever you use it for an actual emergency. Review your fund annually to ensure it still meets your needs. Life changes, and so might your financial requirements. Adjust the amount if your expenses increase. This ongoing commitment ensures your financial security remains robust. It is a continuous process of responsible financial planning. Prioritizing this fund is an investment in your future. It provides a solid foundation for all other financial goals.

Conclusion

An emergency fund is a cornerstone of sound personal finance. It provides a crucial safety net for unforeseen events. From unexpected job loss to medical emergencies, this fund protects your financial stability. While the 3-6 month rule offers a strong starting point, personalize it. Consider your job security, family size, and income stability. Keep these funds in liquid, safe, and accessible accounts. High-yield savings accounts are often the best choice. Building this fund requires consistent effort and discipline. Automate your savings and prioritize contributions. Once established, commit to maintaining and replenishing it as needed.

An emergency fund reduces financial stress. It prevents debt and safeguards your investments. It empowers you to face life’s challenges with confidence. This proactive approach ensures a more secure and resilient financial future. Start building your emergency fund today. It is one of the smartest financial decisions you can make. Your peace of mind is an invaluable asset.