Introduction

Many people face challenges managing their money. The idea of financial freedom often feels distant. Without a clear plan, spending can easily get out of control. Learning to create a personal budget is a crucial step. It provides a roadmap for your money. This guide will help you build your first budget. You will discover practical strategies for financial planning. A personal budget empowers you to make informed decisions. It helps you take control of your financial future. Let’s explore five simple steps. These steps will make budgeting straightforward. This will allow you to achieve your financial goals.

Step 1: Understand Your Income Sources

The very first step to create a personal budget involves knowing your money. You need to identify all your income sources clearly. This includes your regular salary or wages. Do not forget any side hustles. Also, consider freelance work or investment dividends. It is important to calculate your net income. Net income is the money you receive after taxes. This figure is your starting point for budgeting. A precise understanding of your total income is vital. It forms the foundation of effective money management. Knowing your income sets realistic expectations. It prevents overspending later on. Collect all relevant financial statements. This ensures accuracy in your calculations.

Step 2: Track Your Spending Habits

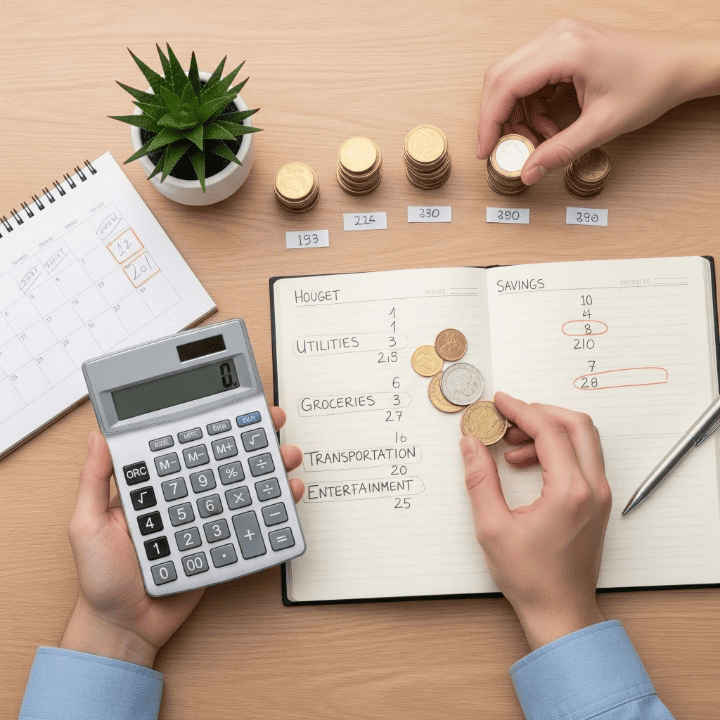

After understanding your income, the next step is to track your spending. Many people are surprised by their actual expenses. For a month, record every dollar you spend. This includes small daily purchases. Use a spreadsheet, app, or notebook. Categorize these expenditures as you go. This process reveals where your money goes. It highlights areas for potential savings. Tracking spending is key to financial planning. It helps you see your true spending patterns. This knowledge is invaluable for creating a personal budget. Be honest and thorough in this step. Every transaction matters for an accurate picture.

Step 3: Categorize and Prioritize Your Expenses

With your spending tracked, it’s time to categorize your expenses. Divide them into fixed and variable costs. Fixed costs remain consistent each month. Examples include rent, mortgage payments, or loan payments. Variable costs fluctuate. Groceries, entertainment, and utilities are variable. Prioritize your essential expenses first. These are housing, food, and transportation. Then, look at discretionary spending. This includes dining out and hobbies. Decide what is truly necessary. This step helps you allocate your funds wisely. Effective money management relies on this prioritization. Creating a personal budget needs this careful review.

Step 4: Set Realistic Financial Goals

Now that you understand your income and expenses, set goals. What do you want your money to achieve? These financial goals should be SMART. That means specific, measurable, achievable, relevant, and time-bound. Examples include saving for a down payment. You might want to pay off debt. Perhaps you are planning for retirement. Break larger goals into smaller, manageable steps. Assign a specific amount to each goal in your budget. This gives purpose to your financial planning. It helps maintain motivation over time. Realistic goals make your personal budget effective. They guide your saving and spending decisions.

Step 5: Review and Adjust Your Budget Regularly

Creating a personal budget is not a one-time task. It requires ongoing attention and adjustment. Life circumstances change frequently. Your income might increase or decrease. Expenses can also fluctuate unexpectedly. Review your budget at least once a month. Compare your actual spending to your plan. Identify any discrepancies or areas for improvement. Adjust your budget as needed to reflect changes. This iterative process is crucial for success. Consistent money management ensures long-term financial health. Regularly reviewing keeps your financial goals on track. This flexible approach makes your budget sustainable.

The Power of Saving and Investing

Beyond just managing expenses, a personal budget opens doors. It allows you to build significant savings. Emergency funds become a reachable goal. These funds provide a safety net for unexpected events. A budget also creates opportunities for investing. Even small, regular investments can grow substantially. Understanding different investment options is key. Stocks, bonds, and mutual funds are common choices. Diversifying your portfolio can reduce risk. Consider long-term growth strategies. Investing is a powerful tool for wealth accumulation. It helps you reach major financial milestones. Your personal budget makes this possible.

Understanding Different Investment Vehicles

Exploring various investment vehicles is important. Each offers different risk and return profiles. Stocks represent ownership in a company. They can provide significant growth potential. Bonds are loans made to companies or governments. They generally offer lower risk, with fixed returns. Mutual funds pool money from many investors. They invest in a diversified portfolio of assets. Exchange-Traded Funds (ETFs) are similar. However, they trade like stocks on exchanges. Real estate is another investment option. It offers potential for appreciation and rental income. Cryptocurrencies are a newer asset class. They are known for high volatility. Understanding these differences helps you make informed choices. Your personal budget helps allocate funds here.

The Role of Insurance in Financial Planning

Insurance is a critical component of financial planning. It protects you and your assets from unforeseen risks. Life insurance provides for your loved ones. Health insurance covers medical expenses. Auto insurance protects against vehicle damage. Homeowner’s insurance shields your property. Disability insurance replaces lost income. These policies act as a financial safety net. They prevent major setbacks to your budget. Adequate coverage minimizes financial stress. It safeguards your hard-earned savings. Your personal budget should include insurance premiums. This ensures comprehensive financial security. It is a smart move for long-term stability.

Planning for Retirement: A Long-Term View

Retirement planning should begin early. A personal budget is essential for this. It allows you to consistently save for your future. Understand different retirement accounts. 401(k)s and IRAs offer tax advantages. They help your money grow over time. Consider your desired lifestyle in retirement. Estimate your future expenses. This will determine how much you need to save. Professional financial advisors can help. They provide guidance on complex strategies. Early and consistent contributions are key. Compounding interest works wonders over decades. Your personal budget provides the discipline needed. It is a cornerstone of a comfortable retirement.

Conclusion

Creating a personal budget might seem daunting initially. However, it is a truly empowering financial tool. We have covered five simple, actionable steps. These include understanding income and tracking expenses. Categorizing costs and setting goals are also crucial. Remember to review and adjust your budget regularly. This ensures it remains relevant to your life. A well-managed budget unlocks financial opportunities. It enables saving, investing, and planning for the future. You gain control over your money. This reduces stress and builds confidence. Start your budgeting journey today. Take these steps towards a more secure financial future. Your financial well-being is worth the effort. Embrace these principles for lasting financial health.