Introduction

Navigating the world of retirement planning can be challenging. Many options exist for securing your financial future. Two prominent choices are the 401(k) and the Roth IRA. Understanding their differences is crucial for effective planning. This article will help you decide which account suits your needs. We will explore their structures, benefits, and drawbacks in detail. Making an informed choice now can significantly impact your retirement lifestyle. Your financial goals deserve careful consideration. Let us compare 401(k) vs. Roth IRA side-by-side.

Understanding the 401(k) Retirement Plan

A 401(k) is an employer-sponsored retirement savings plan. It allows employees to save and invest for retirement. Contributions are typically made on a pre-tax basis. This means they reduce your current taxable income. Money grows tax-deferred until retirement withdrawals. Many employers offer matching contributions. This is essentially “free money” for your retirement. The growth within the account is not taxed annually. This compounding can significantly boost your savings.

There are contribution limits for 401(k) plans. These limits are set by the IRS and change periodically. In 2024, the limit for employee contributions is $23,000. Individuals aged 50 and over can make additional catch-up contributions. These plans often offer a range of investment options. These may include mutual funds, index funds, and target-date funds. Withdrawals in retirement are taxed as ordinary income. Early withdrawals before age 59½ often incur penalties. It is essential to understand your plan’s specific rules. Employer plans can vary widely in their offerings.

Delving into the Roth IRA Retirement Account

The Roth IRA is an individual retirement arrangement. It offers a different tax advantage. Contributions to a Roth IRA are made with after-tax money. This means you do not get an upfront tax deduction. However, qualified withdrawals in retirement are completely tax-free. This includes both your contributions and all earnings. This tax-free growth is a significant benefit. It can be especially attractive for younger investors. Those anticipating higher tax brackets in retirement may also prefer it.

Similar to 401(k)s, Roth IRAs have contribution limits. In 2024, the maximum contribution is $7,000. Individuals aged 50 and over can contribute an extra $1,000. There are also income limitations for contributing to a Roth IRA. If your modified adjusted gross income is too high, you might be ineligible. However, strategies like the “backdoor Roth” exist. These allow high-income earners to contribute indirectly. Roth IRAs offer immense flexibility in investment choices. You can invest in stocks, bonds, mutual funds, and ETFs. This broad selection allows for personalized portfolio construction.

Key Differences: 401(k) vs. Roth IRA

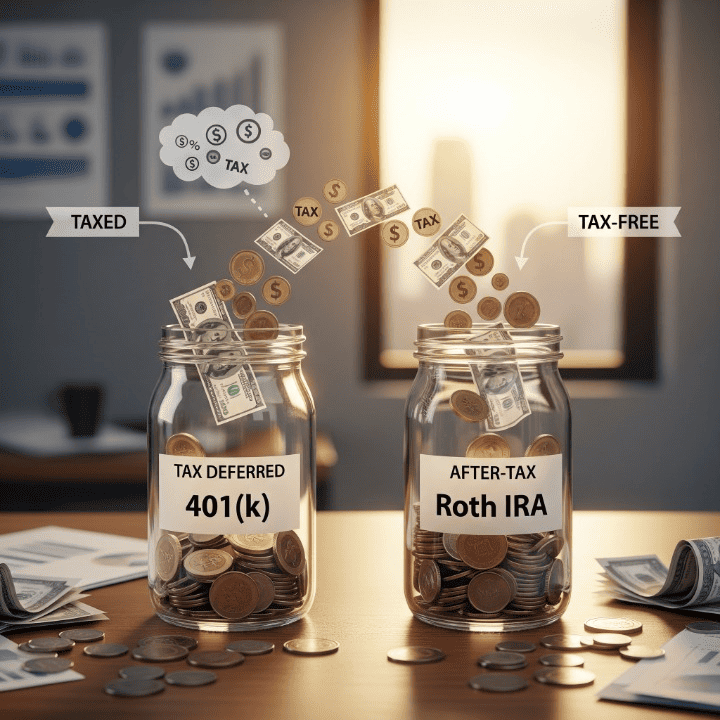

The fundamental difference lies in their tax treatment. A traditional 401(k) offers pre-tax contributions. This provides an immediate tax deduction. Withdrawals are taxed in retirement. A Roth IRA uses after-tax contributions. This means no immediate tax deduction. However, qualified withdrawals are tax-free. This distinction is central to choosing between them. Your current and future tax situations are critical factors.

Another key difference is employer involvement. 401(k)s are employer-sponsored plans. They are offered through your workplace. Roth IRAs are individual accounts. You can open one independently at any brokerage. This means you can have a Roth IRA even without a job. You can also have both accounts simultaneously. Contribution limits also vary. 401(k) limits are significantly higher than Roth IRA limits. This allows for greater pre-tax savings. Income limitations apply to Roth IRA contributions. They do not apply to direct 401(k) contributions.

Investment flexibility also differs. A 401(k) typically offers a curated list of funds. These are chosen by your employer’s plan administrator. A Roth IRA usually offers a wider universe of investments. You have more control over your portfolio. This can be appealing to hands-on investors. Finally, withdrawal rules have some variations. Roth IRA contributions can be withdrawn tax-free at any time. This is not true for 401(k) contributions or earnings.

Who Should Choose a 401(k)?

A 401(k) is often ideal for individuals currently in a high tax bracket. The pre-tax contributions reduce your taxable income now. This can lead to significant tax savings today. Many employers offer a matching contribution. This is a powerful incentive. It effectively provides an immediate return on your investment. Not taking advantage of a match is leaving money on the table.

Consider a 401(k) if you anticipate being in a lower tax bracket in retirement. This strategy allows you to defer taxes until then. You pay taxes when your income is lower. It is also beneficial for those who prefer simplicity. Your employer handles much of the administration. Contributions are often automatic payroll deductions. This makes saving consistent and effortless. If you want to save a large amount for retirement, 401(k) limits are higher. This allows for substantial pre-tax accumulation over time.

For employees whose companies offer a strong 401(k) plan, it is a primary tool. Always contribute at least enough to get the full employer match. This should be your first step in retirement savings. After maximizing your match, you can then explore other options. The power of tax-deferred growth is immense. It allows your money to compound faster. This account can be a cornerstone of your retirement plan.

Who Should Choose a Roth IRA?

A Roth IRA is generally better suited for those in lower tax brackets now. This includes younger individuals starting their careers. It also applies to those with modest current incomes. You pay taxes on your contributions today. This allows for tax-free withdrawals in retirement. This is highly advantageous if you expect higher income later. If your income grows, your tax bracket will likely increase.

Consider a Roth IRA if you value tax-free income in retirement. This provides certainty regarding future tax burdens. It is also excellent for flexibility. You can withdraw your contributions at any time. This can serve as an emergency fund, if necessary. However, it is always better to keep retirement funds separate. The broad investment options appeal to many investors. You have full control over your portfolio choices. This allows for tailored investment strategies.

If you are a high-income earner, a direct Roth IRA might be unavailable. However, the “backdoor Roth IRA” strategy is an option. This allows you to contribute after-tax money to a traditional IRA. Then you convert it to a Roth IRA. This circumvents income limits for direct contributions. Always consult a financial advisor for complex tax situations. A Roth IRA is a powerful tool for tax diversification. It adds flexibility to your overall retirement strategy.

Combining 401(k) and Roth IRA for Optimal Planning

For many people, the best strategy involves using both accounts. This approach combines the advantages of each. It creates a well-rounded and tax-diversified retirement plan. Start by contributing enough to your 401(k) to get the full employer match. This ensures you capture all available “free money.” This should always be the priority. Maximizing your employer match is a critical first step.

After securing your 401(k) match, consider contributing to a Roth IRA. This is especially true if you qualify based on income. A Roth IRA provides tax-free growth and withdrawals. It adds valuable tax diversification to your portfolio. If you max out your Roth IRA, revisit your 401(k). Contribute more if you can afford it. Consider contributing to a Roth 401(k) if available. A Roth 401(k) combines features of both. It offers employer-sponsored tax-free withdrawals.

This layered approach offers significant benefits. You get immediate tax deductions from your traditional 401(k). You also benefit from tax-free income in retirement from your Roth IRA. This strategy provides flexibility for future tax changes. It hedges against uncertainty in tax laws. Having both pre-tax and after-tax savings is wise. It gives you more options when you retire. This dual strategy can optimize your long-term financial health. Diversification is key not just in investments, but in tax treatment too.

Conclusion

Choosing between a 401(k) and a Roth IRA is a crucial decision. Both offer distinct advantages for retirement savings. The 401(k) provides pre-tax contributions and employer matches. It defers taxes until retirement. The Roth IRA offers after-tax contributions and tax-free withdrawals. Your current income, future tax expectations, and employer benefits are key. Carefully assess your personal financial situation. Many find value in utilizing both accounts.

A combined approach offers maximum flexibility. It helps mitigate future tax uncertainties. Remember to always prioritize your employer’s 401(k) match. That “free money” is too good to pass up. After that, explore a Roth IRA for its tax-free growth. Consult with a financial advisor for personalized guidance. They can help you navigate complex decisions. Investing in your retirement now secures your future. Make informed choices for a comfortable and financially sound retirement. Your long-term well-being depends on it.