Introduction

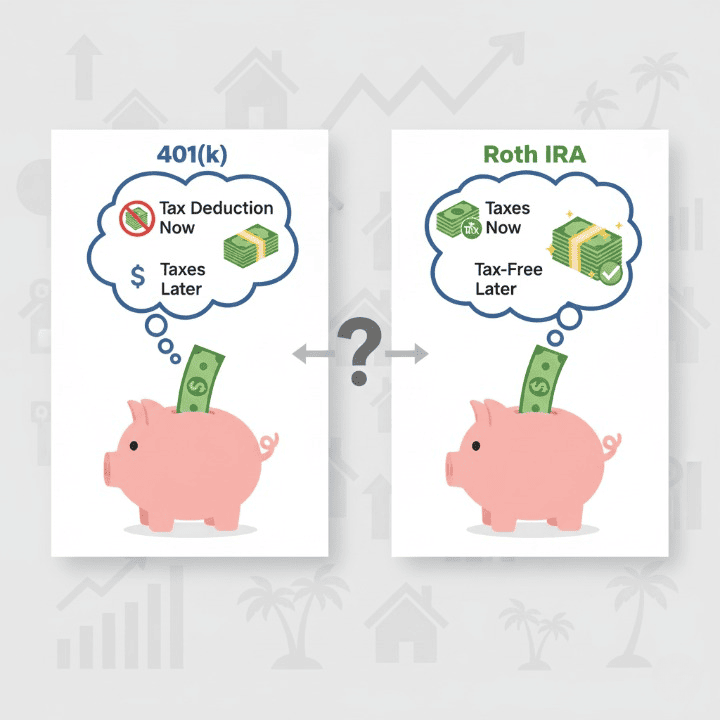

Choosing the best retirement savings vehicle can feel daunting. Many individuals wonder how to secure their financial future. Two popular options stand out in the retirement planning landscape. These are the 401(k) and the Roth IRA.

Both offer distinct advantages for long-term savings. Understanding their key differences is crucial. This knowledge empowers you to make an informed decision. Your choice significantly impacts your retirement finances. It affects how your investments grow over time. It also influences how you pay taxes later.

This article will explore each account type in detail. We will compare their features, benefits, and limitations. Our goal is to help you determine which option, or combination, aligns with your financial goals. Consider your personal circumstances carefully. This includes your current income and future tax expectations. Let’s dive into these important **retirement accounts**.

Understanding the 401(k)

A 401(k) is an employer-sponsored retirement plan. It allows employees to save and invest for retirement. Contributions are typically made on a **pre-tax basis**. This means money is deducted from your paycheck. It is invested before income taxes are applied. Your taxable income is reduced in the current year. This provides an immediate tax benefit.

The money in your 401(k) grows **tax-deferred**. You do not pay taxes on earnings each year. Taxes are only paid when you withdraw funds in retirement. Most plans offer various investment options. These often include mutual funds and target-date funds. Some plans also offer exchange-traded funds (ETFs).

There are annual contribution limits set by the IRS. These limits are generally higher than for IRAs. A significant benefit of a 401(k) is the potential for an **employer match**. Many employers contribute a percentage of your salary. This match is essentially “free money” for your retirement savings. It is a powerful incentive to participate in your company’s plan. It greatly boosts your overall **long-term savings**.

Employer matching contributions often come with a **vesting schedule**. This means you must work for the company for a certain period. Only then do you fully own the employer’s contributions. Leaving before being fully vested may mean forfeiting some matched funds. It is important to understand your plan’s specific vesting rules.

Withdrawals before age 59½ typically incur a 10% penalty. This is in addition to regular income taxes. There are some exceptions, but generally, a 401(k) is for long-term retirement use. Carefully consider these rules before making early withdrawals. They can significantly impact your retirement nest egg.

Types of 401(k)s

The most common type is the **Traditional 401(k)**. As discussed, it uses pre-tax contributions. Withdrawals are taxed as ordinary income in retirement. This is the primary model for most employer plans. It offers current tax deductions.

Some employers also offer a **Roth 401(k)** option. With a Roth 401(k), contributions are made with after-tax money. The money grows tax-free, similar to a Roth IRA. Qualified withdrawals in retirement are also tax-free. We will discuss Roth accounts more when comparing with the Roth IRA.

Exploring the Roth IRA

A Roth IRA is an individual retirement account. It is funded with **after-tax contributions**. This means you contribute money on which you have already paid taxes. Unlike a Traditional 401(k), there is no upfront tax deduction. Your contributions do not lower your current taxable income. However, the benefits come later in life.

The principal and earnings in a Roth IRA grow **tax-free**. This is a major advantage. When you take qualified distributions in retirement, they are completely tax-free. This can be immensely beneficial if you expect to be in a higher tax bracket later. You avoid taxes on decades of investment growth. This is a powerful tool for **retirement planning**.

To be considered a qualified distribution, two conditions must be met. First, the account must be open for at least five years. Second, you must be at least age 59½. Other qualifying events include disability or using funds for a first-time home purchase. Always check the specific rules for withdrawals.

Roth IRAs offer a wider range of investment choices. You typically have control over your investments. This includes stocks, bonds, mutual funds, and ETFs. Some platforms even allow for investments in digital assets. This provides great flexibility for your **investment strategies**. You can tailor your portfolio to your risk tolerance.

One unique feature of a Roth IRA is its flexibility. You can withdraw your direct contributions at any time, tax-free and penalty-free. This access to your principal can act as an emergency fund. However, withdrawing earnings before meeting qualified distribution rules will incur taxes and penalties. It is generally best to let the money grow.

Roth IRA Eligibility and Limitations

There are income limitations for contributing to a Roth IRA. If your modified adjusted gross income (MAGI) exceeds certain thresholds, your contribution limit may be reduced. Eventually, you may be phased out completely. These limits are updated annually by the IRS. It’s important to check current income requirements.

For individuals with incomes above the direct contribution limits, there’s a strategy called the **backdoor Roth IRA**. This involves contributing to a Traditional IRA. You then convert it to a Roth IRA. This allows high earners to access the benefits of a Roth IRA. It is a more complex strategy, so research is vital. Consult a financial advisor for specific guidance.

Key Differences: 401(k) vs. Roth IRA

When comparing a **401(k) vs. Roth IRA**, several critical distinctions emerge. These differences influence your immediate finances. They also shape your long-term **financial planning**. Understanding these points helps clarify which account fits your needs best. Let’s break down the main comparisons.

- **Tax Treatment:**

- **401(k):** Contributions are typically pre-tax. They reduce your current taxable income. Investments grow tax-deferred. Withdrawals in retirement are taxed as ordinary income.

- **Roth IRA:** Contributions are after-tax. There is no immediate tax deduction. Investments grow tax-free. Qualified withdrawals in retirement are also completely tax-free.

- **Contribution Limits:**

- **401(k):** Generally much higher annual contribution limits. These limits are set by the IRS. They are often increased for those aged 50 and over (catch-up contributions).

- **Roth IRA:** Lower annual contribution limits than 401(k)s. Catch-up contributions for those 50 and older are also available, but the overall limit remains lower.

- **Employer Match:**

- **401(k):** Many employers offer matching contributions. This is a significant benefit. It represents “free money” for your retirement. Always contribute enough to get the full match.

- **Roth IRA:** These are individual accounts. There is no possibility of an employer match. All contributions come directly from the account holder.

- **Investment Flexibility:**

- **401(k):** Investment options are limited to what the plan administrator offers. This usually includes a selection of mutual funds and ETFs.

- **Roth IRA:** Offers greater investment control and flexibility. You can invest in a wide array of assets. This includes individual stocks, bonds, mutual funds, and even some alternative assets.

- **Income Limitations:**

- **401(k):** Generally, there are no income restrictions for contributing to a 401(k). Anyone whose employer offers a plan can participate.

- **Roth IRA:** Has specific income phase-out limits. If your income exceeds these limits, your ability to contribute directly is reduced or eliminated.

- **Withdrawals in Retirement:**

- **401(k):** All qualified withdrawals are taxed as ordinary income. This is a key consideration for your retirement budget.

- **Roth IRA:** Qualified withdrawals are entirely tax-free. This offers predictability in your retirement income.

- **Required Minimum Distributions (RMDs):**

- **401(k):** Traditional 401(k)s are subject to RMDs at a certain age. You must start withdrawing funds annually.

- **Roth IRA:** Roth IRAs do not have RMDs for the original owner. This allows your money to continue growing tax-free for longer. RMDs apply to beneficiaries, however.

Deciding Which is Right for You

Choosing between a **401(k) vs. Roth IRA** is not a one-size-fits-all decision. Your personal financial situation and goals are paramount. Consider several factors carefully. This will help you select the most advantageous retirement vehicle. Or, perhaps, a combination of both.

Consider Your Current Tax Bracket

If you are currently in a high tax bracket, a Traditional 401(k) might be appealing. The pre-tax contributions offer an immediate tax deduction. This reduces your current taxable income. It can provide significant tax savings today. You essentially defer paying taxes until retirement.

Conversely, if you are in a lower tax bracket now, a Roth IRA could be ideal. You pay taxes on your contributions today. Then, all qualified withdrawals in retirement are tax-free. This is very beneficial if you expect to be in a higher tax bracket later in life. This strategy optimizes your **tax advantages** over time.

Anticipated Future Tax Bracket

Think about where you expect your income to be in retirement. Do you anticipate a lower income, and thus a lower tax bracket? A Traditional 401(k) might make sense. You pay taxes when your income is lower. Do you foresee a higher income, or higher tax rates in general? A Roth IRA shields your withdrawals from future taxes. This provides valuable tax diversification.

Access to Employer Match

Always prioritize contributing to your 401(k) if your employer offers a match. This is essentially free money. It provides an immediate return on your investment. Failing to capture the full match means leaving money on the table. This should be a top priority in your **investment strategies**.

Investment Control and Flexibility

If you desire more control over your investment choices, a Roth IRA might be preferable. It often offers a broader range of investment options. You can curate your portfolio more actively. A 401(k) usually has a more limited selection. It depends on your employer’s chosen plan administrator.

Income Level and Eligibility

Be mindful of the income limitations for direct Roth IRA contributions. If your income exceeds these thresholds, you might need to explore a backdoor Roth IRA. There are no such income limits for contributing to a 401(k). This can simplify participation for high earners.

Flexibility for Early Access

The Roth IRA offers a unique advantage. You can withdraw your direct contributions tax-free and penalty-free at any time. This flexibility can be useful for emergencies. However, withdrawing earnings early will incur penalties. This feature provides a degree of liquidity not typically found in a 401(k).

Scenarios for Choosing

- **Young Professional:** Often in a lower tax bracket. A Roth IRA can be very attractive. It locks in tax-free growth for decades.

- **Mid-Career High Earner:** May benefit from the immediate tax deduction of a Traditional 401(k). Also, a Roth 401(k) or backdoor Roth IRA could be considered.

- **Approaching Retirement:** Focus on maximizing contributions. Consider tax implications of withdrawals. Diversify tax types for future flexibility.

Combining Both for a Robust Retirement Strategy

For many individuals, the optimal approach is not to choose one over the other. Instead, it is to utilize both a 401(k) and a Roth IRA. This strategy provides maximum flexibility. It also allows you to benefit from different **tax advantages**. This creates a truly robust **retirement planning** framework. It diversifies your future tax exposure.

Start by contributing to your 401(k) up to the employer match. This secures the “free money” from your company. Once you’ve maximized the match, consider funding a Roth IRA. This allows you to benefit from tax-free growth and withdrawals. If you max out your Roth IRA, then consider increasing your 401(k) contributions further. This approach covers all bases.

Having both pre-tax and after-tax retirement savings gives you options. In retirement, you can strategically draw from either account. This depends on your income needs and the prevailing tax rates. If tax rates are high, you can draw from your Roth IRA tax-free. If they are lower, you might withdraw from your 401(k). This is effective **financial planning**.

This dual approach is an advanced **investment strategies** technique. It helps you manage your tax burden throughout your retirement years. It also allows for greater portfolio diversification. You can invest differently within each account. This helps align with your overall risk tolerance. It truly optimizes your **retirement accounts**.

Conclusion

Deciding between a **401(k) vs. Roth IRA** is a crucial step for your financial future. Both offer powerful benefits for long-term savings. The best choice ultimately depends on your unique circumstances. Consider your current income, future tax expectations, and access to an employer match. Each account has distinct features that cater to different financial situations.

The Traditional 401(k) offers immediate tax deductions. Its growth is tax-deferred. The Roth IRA provides tax-free growth and withdrawals in retirement. It also offers more investment flexibility. For many, a balanced approach combining both accounts offers the most comprehensive **retirement planning**. This strategy maximizes **tax advantages** and provides future flexibility.

Proactive **financial planning** is key to a secure retirement. Do not hesitate to seek personalized advice. A qualified financial advisor can help you tailor a strategy. They can ensure your choices align with your individual goals. Make informed decisions today to build the retirement you envision. Your future self will thank you for it.